41 arizona department of revenue

Solved: Can anyone give me the arizona federal id number ... I have emailed the state DOR, and have had great success getting a quick response as well. Of course when your from Kansas, most states think of fields of wheat and corn - and it helps. Especially NY & DC & CA. Mailing address of Shawnee Mission - hell, they think I live on a reservation - I have been asked that 😉. 0 Cheers. Arizona Department of Revenue explains how Prop 208 ... The Arizona Department of Revenue is now offering guidance on how that will impact taxpayers. The state's Department of Revenue says that those impacted by the change don't need to take any additional actions this tax season, regardless of whether they've already filed their taxes.

RV - Revenue, Department of | AZ Direct - Arizona Arizona Tax Forms Toll-free: (800) 352-4090 (International calls and from area codes 520 and 928 only) Live Chat (For general questions only)

Arizona department of revenue

PDF Arizona Department of Revenue The Arizona Department of Revenue has established descriptions for those who participate in the Federal/State Electronic Filing Program. This section is a supplement to those definitions and procedures provided in the IRS E-File Handbook. Electronic Filer: This is a collective term used to refer to all participants in the Federal/State ... Arizona Department of Revenue holding auction to find ... The Arizona Department of Revenue is opening its vault this week to put an assortment of unclaimed property up for auction. Sierra Auction will conduct the online auction, which lasts until ... Printable Arizona Income Tax Forms for Tax Year 2021 Arizona has a state income tax that ranges between 2.590% and 4.500%. For your convenience, Tax-Brackets.org provides printable copies of 96 current personal income tax forms from the Arizona Department of Revenue. The current tax year is 2021, with tax returns due in April 2022. Most states will release updated tax forms between January and April.

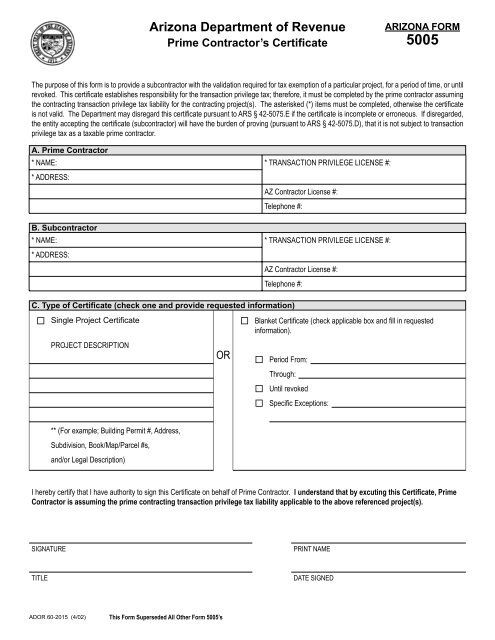

Arizona department of revenue. E-File Services | Arizona Department of Revenue License Renewal: The Arizona Department of Revenue (ADOR) is reminding businesses that have not renewed their 2022 Transaction Privilege Tax (TPT) License to complete the licensing renewal process.Click here for more information.. Customer Notice: To schedule an appointment, please contact us at [email protected]. State of Arizona - Arizona Department of Revenue Company ... State of Arizona - Arizona Department of Revenue Profile and History . The mission of the Arizona Department of Revenue is to Serve Taxpayers. Tax laws that fall under the departments purview are primarily in the areas of income, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance. PDF ARIZONA DEPARTMENT OF REVENUE - AZTaxes ARIZONA DEPARTMENT OF REVENUE 05/04/11 Implementation Guide for Third Party Transmitters & Payroll Service Providers Utilizing Web Services Version 1.5 This document describes how Third Party Transmitters and Payroll Service Providers utilizing Web Services will electronically file and pay Arizona Withholding Tax returns with ... PDF Arizona Department of Revenue - Arizona Auditor General Arizona Department of Revenue Transmitted herewith is a report of the Auditor General, A Performance Audit of the Arizona Department of Revenue—Transaction Privilege Tax Administration and Enforcement. This report is in response to a September 14, 2016, resolution of the Joint Legislative Audit Committee. The

ARIZONA DEPARTMENT OF REVENUE - 43 Reviews - Public ... Specialties: Tax laws that fall under the department's purview are primarily in the areas of income, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance. Established in 1974. The Department of Revenue's origins predate Arizona statehood. The State Tax Commission, established in 1912, consisted of a three-member, non-partisan board elected ... AZTaxes - Arizona Department of Revenue AZ Web File is available to Payroll Service Providers to save time, money and paper and to meet the requirements to electronically file and pay Employer Withholding. azdor.gov › FormsForms | Arizona Department of Revenue Corporate Tax Forms. 120S Schedule K-1 (NR) Nonresident Shareholder's Share of Income and Deductions Form with Instructions. Corporate Tax Forms. 120V. Arizona Corporate or Partnership Income Tax Payment Voucher. Corporate Tax Forms. 120W. Estimated Tax Worksheet for Corporations. Latest News | Arizona Department of Revenue 2022-03-16 · Phoenix, AZ—The Arizona Department of Revenue (ADOR) offers common answers and assistance this tax season as filing taxes can be complex and may lead to questions and errors. ADOR encourages taxpayers to view the common answers during and after filing their tax return. Finalizing Your Return . Read More. Guidance for Taxpayers Following Prop 208 …

azdor.govArizona Department of Revenue - AZDOR The Arizona Department of Revenue (ADOR) is urging businesses to renew their TPT licenses, which are due January 1, 2022. TPT licenses are valid for one calendar year, from January 1 through December 31. Taxpayers must renew the license before continuing business in Arizona. Failure to renew, or renewals after January 1, will incur penalties ... Contact - AZDOR 8:00 am - 5:00 pm MST(Arizona) Monday through Friday. Mailing Address: Arizona Department of Revenue ATTN: Debt Setoff PO BOX 29070 Phoenix, AZ 85038-9070 Phone Number: (602) 716-6262 Email Address: DSO@azdor.gov PDF Arizona Department of Revenue STATE OF ARIZONA EMAIL: GARNISHMENTS@AZDOA.GOV DEPARTMENT OF ADMINISTRATION PHONE: (602) 542-6082 . 100 NORTH 15TH AVENUE, SUITE 302 FAX: (602) 364-2215 . PHOENIX, ARIZONA 85007 . What documents are you required to mail to me? Printable Arizona Income Tax Forms for Tax Year 2021 Arizona has a state income tax that ranges between 2.59% and 4.5%, which is administered by the Arizona Department of Revenue.TaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms. The current tax year is 2021, and most states will release updated tax forms between January and April of 2022.

PDF Arizona Department of Revenue - Arizona Auditor General Arizona Department of Revenue . Transmitted herewith is a report of the Auditor General, A Performance Audit of the Arizona Department of Revenue—Use of Information Technology. This report is in response to an October 3, 2013, resolution of the Joint Legislative Audit Committee. The performance audit

Arizona Department of Revenue | Arizona State Library The Arizona Department of Revenue was established in 1973 to administer Arizona's tax laws (Laws 1973, Chapter 123, effective July 1, 1974). Statutory authority is outlined in two titles of Arizona Revised Statutes: Title 42 - Taxation and Title 43 - Taxation of Income. Regulatory rules are found in the Arizona Administrative Code, Title 15.

View 1099-G - AZTaxes Welcome to Arizona Department of Revenue 1099-G lookup service. The department is now providing Form 1099-G online instead of mailing them. Form 1099-G reports the amount of income tax refunds including credits or offsets. that we paid to you in a tax year if you itemized your federal deductions. The lookup service option is only available for ...

Cisco Chat Keyboard Shortcuts:? Show / hide this help menu: ×

Arizona Department of Revenue - Social Media - YouTube The mission of the Arizona Department of Revenue is to Serve Taxpayers!

State of Arizona Department of Revenue AZTaxes.gov allows electronic filing and payment of Transaction Privilege Tax (TPT), use taxes, and withholding taxes.

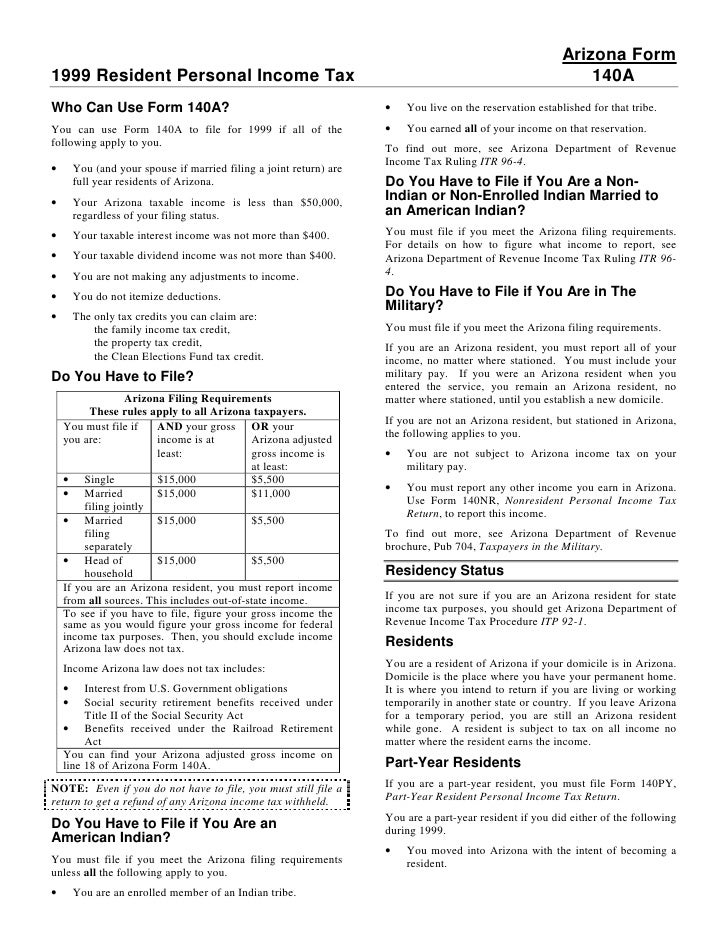

Arizona - Wikipedia Tax is collected by the Arizona Department of Revenue. Arizona collects personal income taxes in five brackets: 2.59%, 2.88%, 3.36%, 4.24% and 4.54%. The state transaction privilege tax is 5.6%; however, county and municipal sales taxes generally add an additional 2%.

Arizona Department of Revenue | LinkedIn The mission of the Arizona Department of Revenue is to Serve Taxpayers! It is our vision that we set the standard for tax services. Tax laws that fall under the department's purview are ...

Arizona | Internal Revenue Service Arizona Commerce Authority. Taxation. Arizona Department of Revenue AZTaxes.gov. Employer Links. Industrial Commission of Arizona Arizona Department of Economic Security New Hire Reporting Center. General. Small Business Administration - Arizona Agency List Arizona Revised Statutes Arizona State Procurement Small Business Services Arizona Counties

Arizona Department of Revenue Phone Number | Call Now ... Arizona Department of Revenue's Best Toll-Free/800 Customer Phone Number. This is Arizona Department of Revenue's best phone number, the real-time current wait on hold and tools for skipping right through those phone lines to get right to a Arizona Department of Revenue agent.

Unclaimed Property | ADOA - Arizona In the State of Arizona, the Department of Revenue is responsible for managing Unclaimed Property. (link is external) . The State of Arizona Surplus Property Management Office does not manage the disposal of Unclaimed Property. Examples of unclaimed property include: dormant bank accounts, uncollected life insurance policies, tax refunds, the ...

Arizona State Tax Tables 2021 | US iCalculator™ The Arizona Department of Revenue is responsible for publishing the latest Arizona State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Arizona. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. This page contains references to ...

AZTaxes State of Arizona Department of Revenue Toggle navigation. Home; License Verification; Individual . Check Refund Status

Printable Arizona Income Tax Forms for Tax Year 2021 Arizona has a state income tax that ranges between 2.590% and 4.500%. For your convenience, Tax-Brackets.org provides printable copies of 96 current personal income tax forms from the Arizona Department of Revenue. The current tax year is 2021, with tax returns due in April 2022. Most states will release updated tax forms between January and April.

Arizona Department of Revenue holding auction to find ... The Arizona Department of Revenue is opening its vault this week to put an assortment of unclaimed property up for auction. Sierra Auction will conduct the online auction, which lasts until ...

PDF Arizona Department of Revenue The Arizona Department of Revenue has established descriptions for those who participate in the Federal/State Electronic Filing Program. This section is a supplement to those definitions and procedures provided in the IRS E-File Handbook. Electronic Filer: This is a collective term used to refer to all participants in the Federal/State ...

0 Response to "41 arizona department of revenue"

Post a Comment